Fill Out a Valid Canada Straight Bill Of Lading Template

The Canada Straight Bill of Lading form is a critical document used in the transportation of goods between the United States and Canada. It serves multiple purposes, including acting as a receipt for the shipment and outlining the terms of the transportation agreement. This form includes essential fields such as the exporter or shipper's information, the ultimate consignee's details, and specific instructions for handling the shipment. It also requires information about the nature of the goods being transported, including their description, quantity, and weight. The form stipulates the conditions of sale and terms of payment, ensuring all parties understand their responsibilities. Additionally, it incorporates customs requirements, necessitating the completion of specific blocks to facilitate smooth cross-border transit. The document not only helps in tracking the shipment but also serves as a legal agreement between the shipper and the carrier, detailing liability and payment terms. Understanding the nuances of this form is crucial for anyone involved in international shipping, as it ensures compliance with both U.S. and Canadian regulations.

Common PDF Templates

What Is Bol - Weight and package details must be provided for accurate shipping costs.

Generic Bol - The Ocean Bill of Lading serves as a key document for exporters, detailing the shipment of goods overseas.

Documents used along the form

The Canada Straight Bill of Lading is a crucial document for the transportation of goods across borders. It serves as a receipt for the cargo and outlines the terms of the shipment. However, several other forms and documents often accompany it to ensure compliance with regulations and facilitate smooth transit. Below are five commonly used forms that complement the Canada Straight Bill of Lading.

- Commercial Invoice: This document details the transaction between the seller and buyer. It includes information such as the description of goods, quantity, price, and terms of sale. Customs authorities often require this invoice to assess duties and taxes.

- Canada Customs Invoice (CCI): Specifically designed for shipments to Canada, the CCI provides Canadian customs with information about the shipment. It includes details like the importer’s information, the value of goods, and a detailed description of the items being imported.

- Export Declaration: This form is required for shipments leaving the United States. It provides the government with information about the goods being exported, including their value and destination. This document helps in monitoring trade and ensuring compliance with export regulations.

- Proof of Delivery (POD): This document serves as evidence that the shipment was delivered to the consignee. It typically includes the signature of the recipient and the date of delivery, providing a record for both the shipper and the carrier.

- Freight Bill: This document outlines the charges associated with transporting the goods. It includes information about the shipment, such as weight, dimensions, and the agreed-upon freight charges. The freight bill is essential for the payment process and helps to clarify costs between parties.

Utilizing these documents in conjunction with the Canada Straight Bill of Lading not only ensures compliance with legal requirements but also facilitates efficient shipping processes. Together, they create a comprehensive framework that supports the smooth movement of goods across borders.

Common mistakes

-

Incomplete Shipper Information: Failing to provide the complete name, address, and ZIP code of the exporter or shipper can lead to significant delays. Ensure that all details are accurate and thorough.

-

Incorrect Consignee Details: Not entering the correct name and address of the ultimate consignee may result in misdelivery. Verify that the consignee's information is precise and complete.

-

Omitting Required Fields: Missing information in essential fields, such as the Bill of Lading number or purchase order number, can cause complications. Double-check that all mandatory fields are filled out correctly.

-

Improper Description of Goods: Providing vague or incomplete descriptions of the commodities can lead to customs issues. Use detailed descriptions to ensure proper classification and compliance.

-

Ignoring Payment Terms: Not clearly indicating the terms of payment, such as whether the charges are prepaid or collect, can create confusion. Be explicit about the payment terms to avoid disputes.

File Overview

| Fact Name | Description |

|---|---|

| Form Purpose | The Canada Straight Bill of Lading serves as a shipping document that outlines the details of the shipment and acts as a receipt for the goods being transported. |

| Exporter/Shipper Information | The form requires the name and address of the exporter or shipper, including ZIP code, ensuring clear identification of the sender. |

| Ultimate Consignee Details | Information about the ultimate consignee, who is the party receiving the goods, must be included, along with their contact number. |

| Bill of Lading Number | A unique Bill of Lading number is assigned to each shipment, facilitating tracking and reference throughout the shipping process. |

| Conditions of Sale | The form includes a section where the terms of sale and payment conditions are specified, clarifying the agreement between the shipper and consignee. |

| Hazardous Materials | If the shipment includes hazardous materials, the form requires the shipper to mark these items accordingly, ensuring compliance with safety regulations. |

| Country of Origin | The country where the goods were produced or manufactured must be indicated, which is essential for customs clearance. |

| Currency of Settlement | The shipper must specify the currency in which payment will be made, which helps avoid confusion during transactions. |

| Regulatory Compliance | The form is governed by various regulations, including the National Motor Freight classifications and the U.S. Department of Transportation rules. |

| Distribution Requirements | Upon completion, the original and copies of the form must be distributed among the shipper, carrier, consignee, and customs broker, ensuring all parties have the necessary documentation. |

Key takeaways

- Complete all required fields: Ensure that you fill out all necessary sections of the Canada Straight Bill of Lading form, especially blocks 7 through 13, 19, 21 through 25, and 31 through 37, as these are crucial for customs compliance.

- Accurate shipper information: Provide the shipper's full name, address, and ZIP code. This ensures that the shipment can be properly tracked and delivered.

- Ultimate consignee details: Clearly state the name and address of the ultimate consignee. This is the party that will receive the goods in Canada.

- Special instructions: If there are any unique handling or delivery requirements, make sure to include these in the special instructions section.

- Weight and packaging: Enter the total shipping weight and specify the types of packaging used. This information is vital for customs and logistics.

- Currency of settlement: Indicate the currency in which payment is to be made. This helps avoid confusion regarding financial transactions.

- Terms of payment: Clearly mark whether the payment is prepaid or collect. This will guide the carrier on how to handle the freight charges.

- Signature requirements: Ensure that the consignor's signature is included where required. This confirms that the information provided is accurate and complete.

- Distribution of copies: Remember to distribute the original and copies correctly: one for the ODFL driver, one for the consignee, one for the customs broker, and one to be retained by the shipper.

Misconceptions

Misconceptions about the Canada Straight Bill of Lading form can lead to confusion and potential issues in shipping processes. Here are five common misconceptions:

- It is only for shipments to Canada. Many believe that the Canada Straight Bill of Lading is exclusively for shipments entering Canada. In reality, it can also be used for shipments originating from Canada to the U.S. or other countries.

- All fields are optional. Some individuals think that they can skip filling out certain fields. However, specific fields, especially those related to the consignee and shipment details, are required for the form to be valid and for customs clearance.

- The form guarantees delivery. There is a misconception that completing the Canada Straight Bill of Lading guarantees that the shipment will be delivered without issues. While it is an important document, it does not eliminate the possibility of delays or other complications.

- It is the same as a commercial invoice. Many assume that the Canada Straight Bill of Lading serves the same purpose as a commercial invoice. Although both documents are essential, they serve different functions in the shipping process. The bill of lading is a contract of carriage, while the commercial invoice details the transaction.

- Only the shipper needs to sign it. Some people believe that only the shipper's signature is necessary for the Canada Straight Bill of Lading to be valid. However, the consignee may also need to sign, especially in cases of COD shipments, to confirm receipt of the goods.

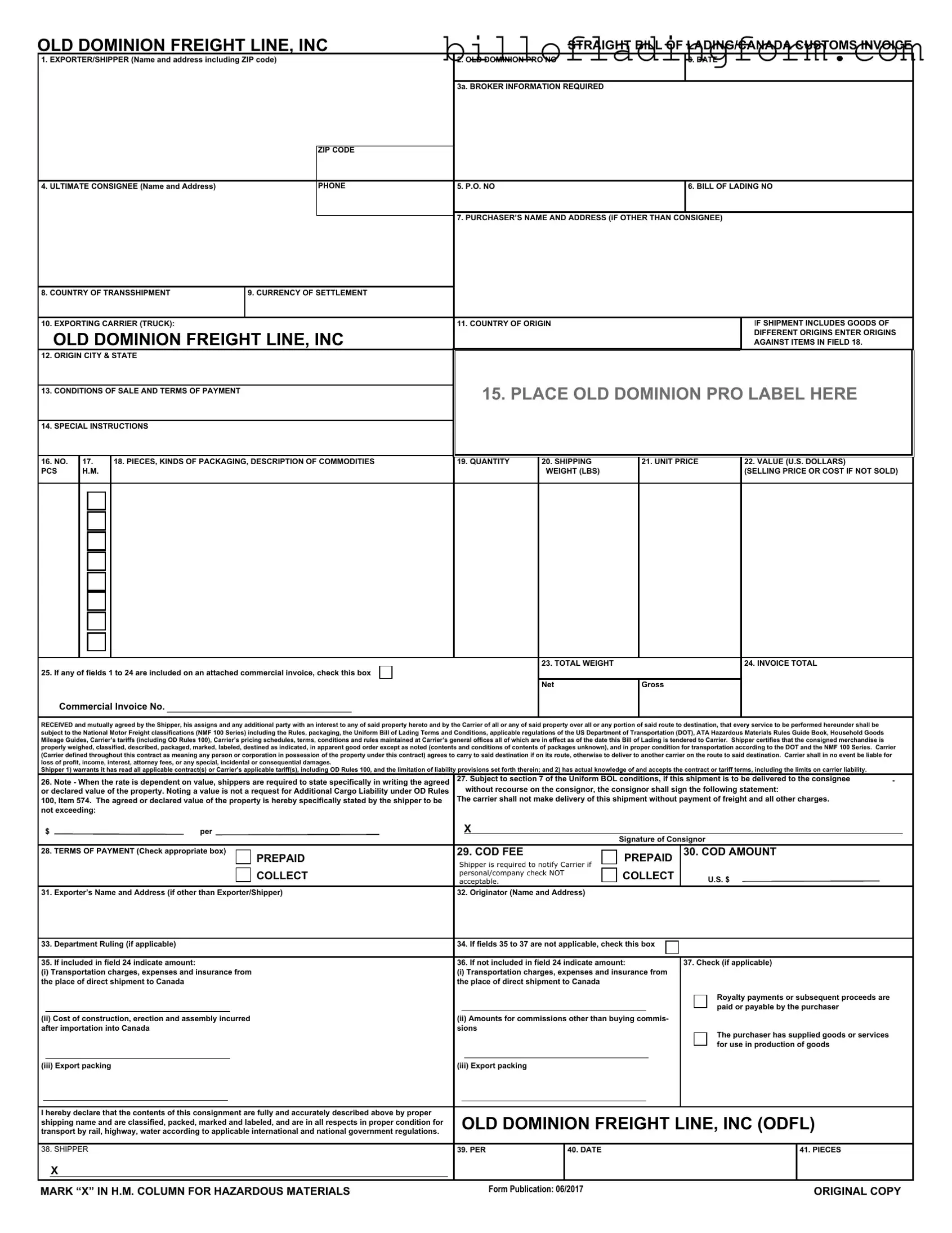

Canada Straight Bill Of Lading Preview

OLD DOMINION FREIGHT LINE, INC |

|

STRAIGHT BILL OF LADING/CANADA CUSTOMS INVOICE |

||||

1. EXPORTER/SHIPPER (Name and address including ZIP code) |

2. OLD DOMINION PRO NO |

|

3. DATE |

|||

|

|

|

|

|

|

|

|

|

|

3a. BROKER INFORMATION REQUIRED |

|||

|

|

|

|

|

|

|

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

4. ULTIMATE CONSIGNEE (Name and Address) |

|

PHONE |

5. P.O. NO |

|

6. BILL OF LADING NO |

|

|

|

|

|

|

|

|

|

|

|

7. PURCHASER’S NAME AND ADDRESS (iF OTHER THAN CONSIGNEE) |

|||

|

|

|

||||

|

|

|

|

|

|

|

8. COUNTRY OF TRANSSHIPMENT |

9. CURRENCY OF SETTLEMENT |

|

|

|

|

|

|

|

|

|

|

|

|

10. EXPORTING CARRIER (TRUCK): |

|

|

11. COUNTRY OF ORIGIN |

|

|

IF SHIPMENT INCLUDES GOODS OF |

OLD DOMINION FREIGHT LINE, INC |

|

|

|

DIFFERENT ORIGINS ENTER ORIGINS |

||

|

|

|

AGAINST ITEMS IN FIELD 18. |

|||

12. ORIGIN CITY & STATE |

|

|

|

|

|

|

13. CONDITIONS OF SALE AND TERMS OF PAYMENT

15. PLACE OLD DOMINION PRO LABEL HERE

14. SPECIAL INSTRUCTIONS

16.NO.

PCS

17.

H.M.

18. PIECES, KINDS OF PACKAGING, DESCRIPTION OF COMMODITIES

19. QUANTITY

20.SHIPPING WEIGHT (LBS)

21. UNIT PRICE

22. VALUE (U.S. DOLLARS)

(SELLING PRICE OR COST IF NOT SOLD)

25.If any of fields 1 to 24 are included on an attached commercial invoice, check this box

Commercial Invoice No.

23. TOTAL WEIGHT

Net |

Gross |

|

|

24. INVOICE TOTAL

RECEIVED and mutually agreed by the Shipper, his assigns and any additional party with an interest to any of said property hereto and by the Carrier of all or any of said property over all or any portion of said route to destination, that every service to be performed hereunder shall be subject to the National Motor Freight classifications (NMF 100 Series) including the Rules, packaging, the Uniform Bill of Lading Terms and Conditions, applicable regulations of the US Department of Transportation (DOT), ATA Hazardous Materials Rules Guide Book, Household Goods Mileage Guides, Carrier’s tariffs (including OD Rules 100), Carrier’s pricing schedules, terms, conditions and rules maintained at Carrier’s general offices all of which are in effect as of the date this Bill of Lading is tendered to Carrier. Shipper certifies that the consigned merchandise is properly weighed, classified, described, packaged, marked, labeled, destined as indicated, in apparent good order except as noted (contents and conditions of contents of packages unknown), and in proper condition for transportation according to the DOT and the NMF 100 Series. Carrier (Carrier defined throughout this contract as meaning any person or corporation in possession of the property under this contract) agrees to carry to said destination if on its route, otherwise to deliver to another carrier on the route to said destination. Carrier shall in no event be liable for loss of profit, income, interest, attorney fees, or any special, incidental or consequential damages.

Shipper 1) warrants it has read all applicable contract(s) or Carrier’s applicable tariff(s), including OD Rules 100, and the limitation of liability provisions set forth therein; and 2) has actual knowledge of and accepts the contract or tariff terms, including the limits on carrier liability.

26. Note - When the rate is dependent on value, shippers are required to state specifically in writing the agreed |

27. Subject to section 7 of the Uniform BOL conditions, if this shipment is to be delivered to the consignee |

- |

|

|||||||||||||||||||||

or declared value of the property. Noting a value is not a request for Additional Cargo Liability under OD Rules |

|

|

without recourse on the consignor, the consignor shall sign the following statement: |

|

|

|||||||||||||||||||

100, Item 574. The agreed or declared value of the property is hereby specifically stated by the shipper to be |

The carrier shall not make delivery of this shipment without payment of freight and all other charges. |

|

|

|||||||||||||||||||||

not exceeding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

$ |

per |

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Consignor |

|

|

|||||||

28. TERMS OF PAYMENT (Check appropriate box) |

|

PREPAID |

29. COD FEE |

|

|

PREPAID |

30. COD AMOUNT |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

Shipper is required to notify Carrier if |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

COLLECT |

personal/company check NOT |

|

|

COLLECT |

|

|

U.S. $ |

|

|

|||||||

|

|

|

|

|

|

|

|

acceptable. |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

31. Exporter’s Name and Address (if other than Exporter/Shipper) |

32. Originator (Name and Address) |

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

33. Department Ruling (if applicable) |

|

|

|

|

|

|

34. If fields 35 to 37 are not applicable, check this box |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35. If included in field 24 indicate amount: |

|

|

|

|

|

|

36. If not included in field 24 indicate amount: |

37. Check (if applicable) |

|

|

||||||||||||||

(i) Transportation charges, expenses and insurance from |

(i) Transportation charges, expenses and insurance from |

|

|

|

|

|

|

|||||||||||||||||

the place of direct shipment to Canada |

|

|

|

|

|

|

the place of direct shipment to Canada |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty payments or subsequent proceeds are |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

paid or payable by the purchaser |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(ii) Cost of construction, erection and assembly incurred |

(ii) Amounts for commissions other than buying commis- |

|

|

|

|

|

|

|||||||||||||||||

after importation into Canada |

|

|

|

|

|

|

sions |

|

|

|

|

|

|

|

|

The purchaser has supplied goods or services |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for use in production of goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(iii) Export packing |

|

|

|

|

|

|

(iii) Export packing |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I hereby declare that the contents of this consignment are fully and accurately described above by proper |

|

OLD DOMINION FREIGHT LINE, INC (ODFL) |

|

|

||||||||||||||||||||

shipping name and are classified, packed, marked and labeled, and are in all respects in proper condition for |

|

|

|

|||||||||||||||||||||

transport by rail, highway, water according to applicable international and national government regulations. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38. SHIPPER |

|

|

|

|

|

|

39. PER |

40. DATE |

|

|

|

41. PIECES |

|

|

||||||||||

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARK “X” IN H.M. COLUMN FOR HAZARDOUS MATERIALS |

|

|

FORM PUBLICATION: 06/2017 |

|

|

|

ORIGINAL COPY |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Instructions for Completing

Straight Bill of Lading / Canada Customs Invoice

NOTE: CANADA CUSTOMS REQUIRES COMPLETION OF BLOCKS 7 THROUGH 13, 19, 21 THROUGH 25 AND 31

THROUGH 37 WHEN APPLICABLE.

1.Complete shipper name, address, city, state and first five digits of the zip code.

2.Enter Old Dominion’s PRO number

3.Enter shipping date.

3a. If known, enter the Canadian broker’s name and phone number in this space.

4.Enter the name, address and phone number (if known) of the party actually receiving the merchandise in Canada.

5.Enter purchase order number(s), if applicable.

6.Enter shipper’s bill of lading number.

7.If a party other than the Ultimate Consignee is purchasing the merchandise, provide the name and address of the Purchaser.

8.If this shipment originate outside of the U.S., enter U.S. as the country of transshipment. Otherwise, leave blank.

9.Indicate the currency in which the shipper requires payment.

10.Old Dominion Freight Line, Inc. is already shown here as the mode of transportation.

11.Enter the name of the country in which the merchandise was mined, grown, manufactured, produced or substantially transformed.

12.Enter the place from which the goods began their uninterrupted journey to Canada.

13.Describe the terms and conditions agreed upon by both shipper and purchaser.

14.Enter special handling or delivery instructions, if any.

15.Place Old Dominion PRO label here.

16.Enter number of package (i.e., bales, cartons, skids) for each separately described article.

17.An “X” must be entered for each hazardous material item

18.Enter kinds of packaging (i.e., bales, cartons, skids). Complete and detailed descriptions of articles using general and commercial terms, since the customs tariff commodity code classification will be determined from this description.

(Use additional forms if more space is needed, and number each page at the top right corner of each form.)

19. Enter the number and type of unit(s). Report whole units.

(Example: If shipping cash registers state “200 each;” if shipping shoes state “500 pairs.”)

20.Enter the gross shipping weight in pounds for each separately described article.

21.Enter the price per unit for each article using the currency of settlement in block 9.

22.Enter the selling price or cost if not sold, stated in the U.S. currency.

23.Enter the total net and gross weight (pounds) of shipment.

24.Enter the total price paid or payable for goods (total value). Total all amounts in block 22 to equal total value.

25.Check this box and enter the commercial invoice number when applicable.

26.State the agreed or declared value (U.S. currency) when the rate is determined by value.

27.Signature of Consignor is required when subject to Section 7 conditions.

28.Enter an “X” in the appropriate box to indicate terms of payment of the freight charges.

____ Prepaid

____ Collect

29.If this is a COD shipment, check appropriate box to specify if the COD fee is Prepaid or Collect.

30.If this is a COD shipment, enter the COD Amount (U.S. currency).

31.Complete this block if the exporter/shipper is other than exporter/shipper name and address shown in block 1.

32.Indicate the name and address of the person and/or firm completing the invoice. The field may be left blank if the information is provided elsewhere on this form.

33.Department rulings are made by Canadian Customs on behalf of a particular shipper’s commodity. If applicable, provide file reference number and date of ruling.

34.If fields 35 to 37 are not applicable, check this box.

35 - 37. Self explanatory.

38. Signature of shipper should be entered here.

39 - 41. To be completed by Old Dominion’s pickup driver.

Distribution

Original and 2 copies - ODFL Driver 1 copy - mail to consignee

1 copy - mail to custom’s broker

1

Dos and Don'ts

Things You Should Do:

- Ensure you fill in the shipper's name, address, and ZIP code accurately to avoid delays.

- Provide the Old Dominion PRO number and the shipping date in the designated fields.

- Include the name and contact information of the ultimate consignee to facilitate smooth delivery.

- Clearly state the terms of payment and ensure they are marked correctly.

Things You Shouldn't Do:

- Do not leave any required fields blank, as this can lead to complications with customs.

- Avoid using vague descriptions; provide detailed information about the commodities being shipped.

- Do not forget to sign the form, as an unsigned bill of lading may not be valid.

- Refrain from using abbreviations or shorthand that may confuse customs officials.